compare mortgage rates canada calculator

In a regular economic surroundings, greater interest charges would be related with the central bank as they consider to great off inflationary pressures associated with an growing cash provide. Even so, with less demand from customers for Treasuries, bigger interest fees to entice purchaser demand is the only practical recourse.

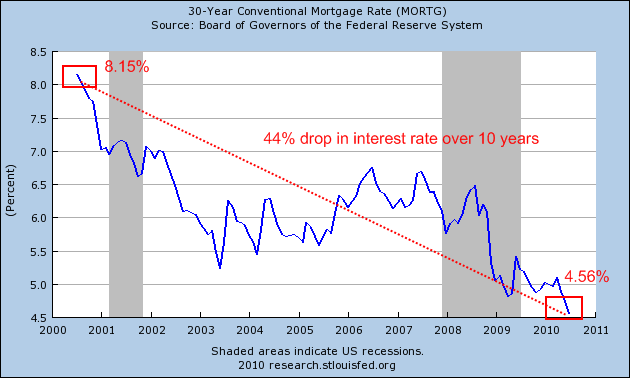

For 30 Yr premiums due to the fact October thirtieth charges have arrive down virtually a complete level. With five 12 months 20 year mortgage rates today Pa higher than thirty yr charges they proceed to be mainly pointless. With 15 many years only a bit below 30 calendar year charges at this time it likely makes sense to get a 30 12 months rate and overpay. In addition, with one calendar year prices only 50 % a stage under 30 year rates, at this place in time thirty year fees are really substantially king. In addition to house loan prices it can be always attention-grabbing to glimpse at what an actual home finance loan payment would be. We applied our home loan calculator to translate today's fees into a mortgage loan payment on a 200k mortgage. We also did the identical point utilizing costs from final 7 days and the fees on October 30th.

Some of the adjustable amount home loans that are offered by lending establishments have a prepayment penalty, which you incur if you shell out the house loan off early. By owning this prepayment penalty, you could be opening by yourself up to a large amount of strife - having a prepayment penalty on your home loan agreement is in no way a excellent strategy for the reason that you simply just do not know what the potential will bring.

If China and other nations refuse to obtain U.S. personal debt, the only substitute is for the U.S. Treasury to order Treasury securities which would considerably boost the income source. To attract investors, curiosity costs would have to have to increase. As is the situation, when the Fed starts getting Treasury bills habitually, inflation ensues. The Fed in the mid-2009 situation has employed significantly of the dollars to buy above $500 billion in property finance loan backed securities.